The definitive guide on how to invest in gold with no experience

Time of publication - 2022.03.31

The concept of investing in gold is simple enough.

Whether you are a beginner or a seasoned investor, there are a number of paths you can take to invest in gold. After that, it’s a matter of the safety measures that can secure gold, which is a tangible asset.

Investing in gold offers a number of benefits. For millennia civilizations considered gold as one of the most robust assets that present undeniable purchasing power.“Gold has a proven track record for returns, liquidity, and low correlations, making it a highly effective diversifier,” executive director of research at the World Gold Council Juan Carlos Artigas comments on why investors like gold.

Not too long ago gold coins circulated as currency before the introduction of paper money. Like today, merchants acknowledged the value of gold all around the world. At the present time, the scope of gold’s value is significantly wider. Not only there are more ways now to invest in gold, but there is also a number of new benefits. Quite frankly, nowadays only a few clicks separate you from becoming an owner of physical gold.

Let’s take a look at the opportunities that are there for you.

How to invest in gold

The more traditional way of investing in gold revolves around purchasing physical gold. However, the domain of gold investment became more sophisticated in this digital age, which is why investors choose to invest in gold in three different ways:

- Investors usually take the common path by acquiring physical metals, like gold coins and gold bars.

- You can purchase shares of a mutual or exchange-traded fund (ETF). A bit more risky move, which doesn’t involve the physical gold itself.

- You can also trade futures in the market of commodities. Such investment obligates to buy or sell a certain amount of gold for an agreed price and date. It also entails commissions that you will have to pay to the bank. The amount depends on the market where futures are traded. Usually, investors with more experience choose this domain.

Here is what you should know about starting to invest in gold with certainty.

Investing in gold bars

One of the most simple and reliable methods to invest is by buying physical gold. Purchasing gold bars is as simple as buying a carton of milk in the grocery store. For example, retailers like Florinus don’t require additional paperwork until a threshold of €10 000. Which also makes it a private investment and prohibits the involvement of third parties.

Investors purchase gold bars for the pure metal content. Today’s variety offers gold bars of very high purity and quality, made by the world’s most trusted certified manufacturers. Gold bars come in various sizes which grants you the freedom to determine the budget that suits you: gold retail stores usually offer bars ranging from

1 gram to

12 kilograms.

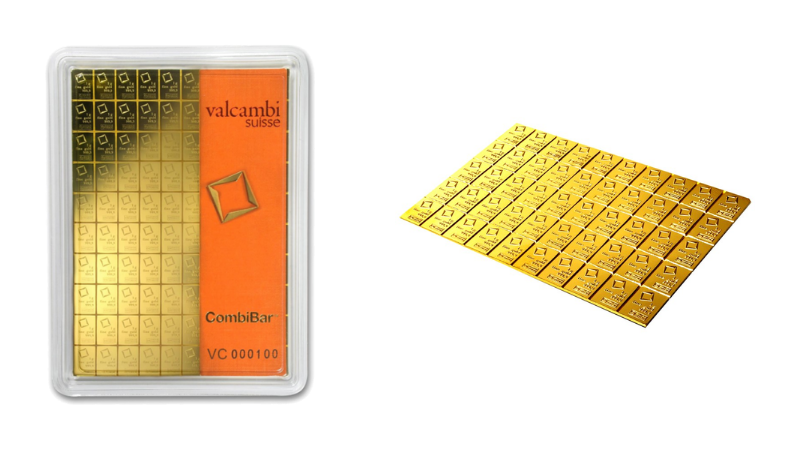

It might not seem like it is, but gold bars can also be quite a liquid asset. What if the situation occurs when you don’t want to sell your whole gold bar? Products of

the Valcambi CombiBar series are multifunctional bars, that are composite of many smaller bars (usually 1g) which offer unconventional liquidity.

The great thing about this investment is that is quite compact, but it also requires appropriate safety measures. Being cautious about this concern might help you to prevent risk factors that come with storing gold at your premises. You can check out the guidelines for

storing gold safely at home in this article.

In addition, different gold refiners also propose different interesting designs. However, unlike gold old bars, gold coins also offer additional numismatic value due to their design, cultural and historical background.

Investing in gold coins

Gold coins are another investment option that offers great liquidity. However, you have to be cautious about this investment as people usually choose coins, sold by reputable retailers of precious metals. The go-to options for gold coin investment are

American Eagle,

South African Krugerrand and

the Canadian Maple Leaf and other coins minted by the world’s trusted manufacturers like Perth Mint, British Royal Mint, United States mint and etc.

The thing about investing in gold coins is that their price doesn’t exactly align with the gold content. Gold coins typically come with bigger premiums on the market price due to extra minting costs and additional numismatic value. For example 1oz. American Eagle coin costs 2011 Є (March 2022), whereas 1 oz. Valcambi's gold bar value stood at 1823 Є. That is around a 10% markup over a comparable amount of gold bullion.

There are also more rare historical coins, where investors rely on their numismatic value that increases with time. Having a gold historical coin is also an interesting addition to your investment portfolio as it lets you have a cultural piece from centuries ago.

Also, you might come across a good deal in some online markets or pawn shops, but generally, it is safer to invest in gold coins with a reputable, licensed gold retail store. Otherwise, inexperienced investors risk overpaying or receiving a counterfeit coin.

Fundamentally, there are a few important principles to consider when investing in physical gold.

How to invest in gold for beginners?

It might sound that gold as an investment is only accessible to people with sky-high incomes. Quite frankly, it is possible for most of us to invest in gold. This metal preserves the value of every single penny and it withstands the test of time both in a physical and monetary sense. Thinking of starting investing in gold? Here is what you need to know.

For beginner investors, the go-to option is usually buying gold bars. The latter usually comes in 999.9 purity, so gold bullion, sold by licensed gold retail stores is usually as pure as it gets. Pure metal content means that your currency figuratively translates into gold, unlike gold coins, which contain additional numismatic value and are more expensive to produce.

To begin with, our specialists advise considering

20 g. gold bars. Bars that are lighter contain larger premiums, which is why it is not recommended for investment reasons.

Think you can raise your stakes and invest in a

100 g. gold bar? Even better. Because the same principle applies here too. If you decide to buy five bars that weigh 20 g. you will pay more for premiums than buying a single 100 g. gold bar. To sum up, the larger the bar, the less premium you will have to cover.

What if a 20 g. gold bar is too expensive?

Silver coins are known to be quite a popular investment option for a small sum of money. Some of our clients religiously allocate a fraction of their income to buy one-ounce silver coins each month. It is not only a reliable way to start accumulating your portfolio of precious metals but is also a great way to save up for your long-term plans. The value of silver is known to be less stable, on the other hand, it offers a chance at bigger profits.

As your investments accumulate it might become complicated to track the performance of your gold assets and take care of the necessary safety concerns that arise.

Luckily investing with Florinus ID offers you an all-in-one solution.

How to invest in gold with Florinus ID

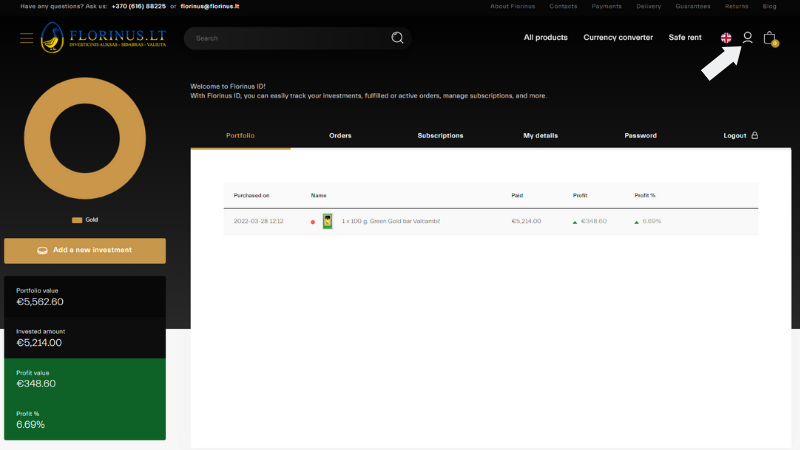

Investing in physical gold has never been more simple. Florinus ID is the digital investment dashboard that allows you to easily track your investments, fulfilled or active orders, manage subscriptions and other features.

Wondering how your gold investment performs in the current landscape of precious metals since the moment you bought it? You can select any piece of physical gold and other precious metals from the Florinus assortment and add it to your investment portfolio. Select the date you bought it and see how investments performed. Florinus ID offers a detailed overview of the value change in profits.

With your growing investment portfolio, there are growing safety concerns that are necessary to help you minimize the risk. Nowadays it is easy to extract unwanted external attention and become a target for thieves by storing physical gold at home. However, for your convenience, Florinus proposes an alternative to setting up your secure gold storage. You can use

Florinus safe renting services and leave security concerns for us. So all you need to do is lay back and see how the value of your investment changes in the Florinus ID dashboard.

Conclusion

Based on history, the price of gold is rising steadily, as from 2002 it increased by more than five times. As you can imagine, the amount of gold on the planet is limited, so consequently, the price of the metal is bound to increase. Moreover, recent political and economical tensions highlighted people's trust in gold, as the current supply chain turned stagnant due to demand increase.

You can hop on the board today, as gold bars weigh as low as 20 g. come with reasonable premiums. You can also start with lighter bars as well, but you would get better value if you consider the 20 g. threshold for investment reasons.

In the long run, the robust nature of this investment covers the need for paper money, coins, plastic cards and cryptocurrencies and the risks that come with it. It also ensures your wealth from huge market fluctuations. If the economic system fails, most of your investments will be rendered useless, while gold will sustain its value.

Sign up for the Florinus newsletter and be the first to learn about inventory additions, exclusive promotions, special offers and much more!

Subscribe to the newsletter