For more than 3 weeks, the ongoing war, as well as economic and political actions, have a huge impact on different markets. Precious metals, which react sharply to all events in the world, are no exception. Let's take a closer look at the gold market, which has been in the spotlight for the past two weeks. What has already happened, what is happening now and what else can we expect?

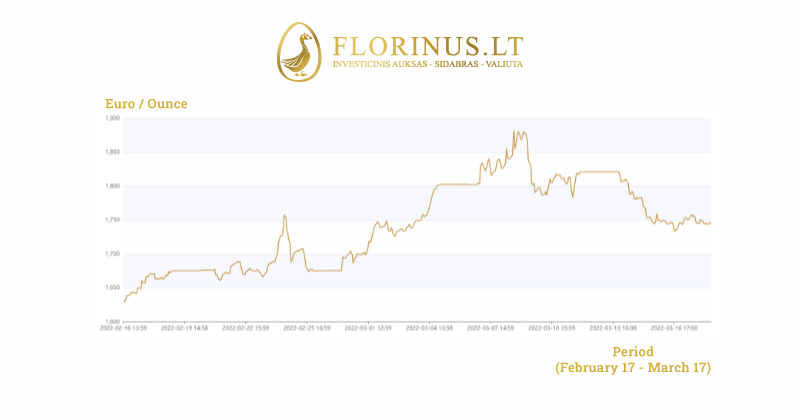

Since the beginning of this year, the cost of gold on the world market has grown by 7.7%. The biggest jump was recorded in the middle of last month. Since February 17, against the background of the geopolitical situation, the price and demand for precious metals also began to grow. Experts and economists may be mistaken, but history is never wrong. From year to year, we observe a trend - as the tension in the world grows, the price and demand for gold grow.

After the outbreak of the war, from February 24, gold quickly reacted to the events in Ukraine. In just a few days after the start of the war, the value of gold rose sharply and reached its peak in the last few years.

Conclusions: In February, the price of gold jumped by 6% to $1,910 per ounce, the biggest increase since May 2021.

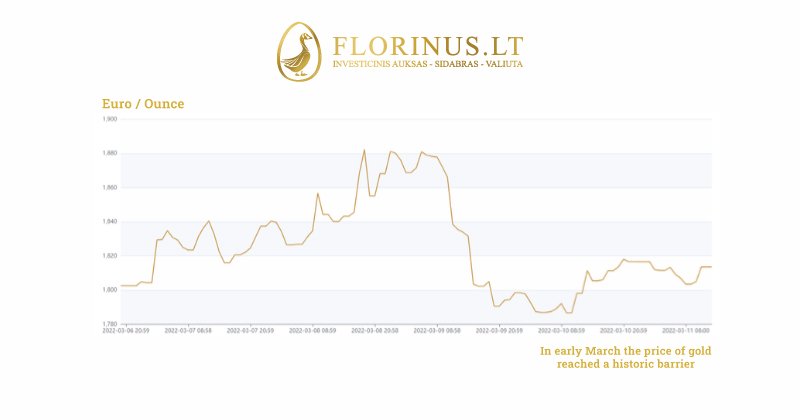

Since March 7th, the price of gold has jumped and broken the $2,000 barrier. The last time gold reached this level was in 2020, when the world faced the first wave of COVID-19. As tensions rise over the Russian-Ukrainian conflict, and as the US and Europe consider importing Russian oil, the precious metals market is increasingly suffering, which is affecting current gold prices. This is only the second time in history that gold has crossed the $2,000 mark, but according to experts, it won't be the last.

Every week, experts raise the question - in what direction is the price of gold moving today? Why? This period is referred to as especially changeable in the market. And although the price of gold fluctuates, in the general table, its curve falls slightly down. A slight rise, a decline, a short-term lull - these are the actualities on the market today. Speaking of next month, Comex gold futures are up 3.3% to date.

No one dares to predict future gold prices. However, summarizing, we can highlight some of the most popular expert forecasts today:

It is worth mentioning that at the moment the situation in the world does not give a clear idea of the future. But what is known for sure is that the geopolitical situation, sanctions and military operations have a very strong impact on the market, the numbers of which can change literally overnight.

As the first day of the war began, the price of gold reached its highest level since the summer of 2020. And the demand for these assets has increased significantly in all Florinus salons in Lithuania. It is estimated that more than 1 million euros worth of precious metals were sold in the early days of the war.

As the experts themselves emphasize, the question is not whether the crisis will occur, but when it will occur and how people will be prepared for it. The authorities suggest stocking up on food for at least a few days, as well as preparing essentials. But the problem is that when the situation is not completely clear and the tipping point is not reached, people do not think about preparation.

What does all this have to do with gold? Having gold is also part of the preparation for the worst-case scenario. As geopolitical events continue to unfold, the price of gold continues to rise. But precious metals are still one of the best hedges against today's market volatility. Gold is a store of value, the credibility of which increases as the credibility of money declines. This is a reliable asset against the backdrop of financial, political and other global unrest.

On the Florinus.lt page, you can watch the price of precious metals live. Florinus gold price charts allow you to track gold prices in real time. You can also check historical gold prices up to 20 years ago. You can find charts for precious metals here.