7386.4 kg - Florinus sold such a record amount of precious metal in 2022. The numbers are impressive as the year of gold has been celebrated all over the world. Demand for gold last year was the highest since 2011, according to data provided by the World Gold Council.

Last year, Central Banks bought the largest amount of gold since 1967 - 1,136 tons, worth about $70 billion. Central banks love gold. Why? Because it is believed that it retains its value in turbulent times, unlike currency or bonds. The attraction of gold also lies in the fact that this precious metal allows central banks to diversify their assets.

The World Gold Council reported that demand for gold rose 28% last year among both individuals and investors as many sought to protect their wealth from inflation.

2022 has certainly been marked by unprecedented change, uncertainty and turmoil in the markets. This has led to record citizens' confidence in precious metals. The numbers in the 2022 report compiled and presented by Florinus are truly impressive. And what is behind them? - lingering geopolitical tensions, or perhaps a loss of faith in the government's ability to control ever-increasing inflation?

In truth, the combination of all these factors is giving rise to increasing confidence in precious metals as more citizens realize that they are traditionally considered a safe and secure investment in times of geopolitical and economic uncertainty.

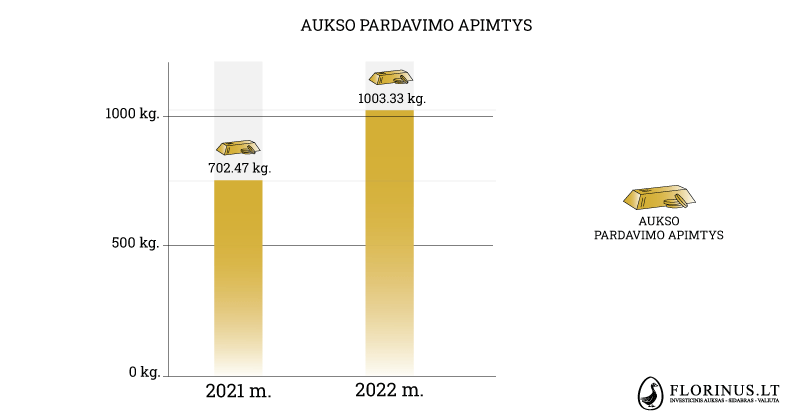

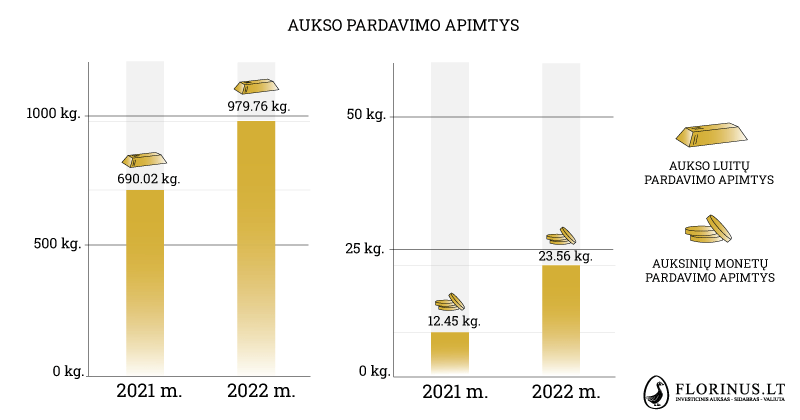

The exclusive report of UAB Florinus shows that gold in 2022 was sold 300 kilograms more than in 2021. Last year, a total of 1003.33 kilograms of gold were sold, including 979.76 kilograms of gold bars, which is more than 38 thousand units, and 23.56 kilograms of gold coins - more than 6 thousand units. In total, almost 2,000 kilograms of gold have been sold over the past two years.

Silver also shows impressive numbers. In total, 6,383.07 kilograms of silver were sold in 2022, including 1,353.27 silver bars and granules, which amounted to more than 5,000 units. Also, 5029.29 kilograms of silver coins were sold, which is 159,075 pieces.

Investors' fear of high inflation, the war between Russia and Ukraine and the recession contributed to an increase in demand for precious metals. And while the yellow metal has experienced ups and downs because of this, it has remained one of the best assets of the past year. As for silver, many analysts tend to predict that the metal will rise in price more than gold due to its volatility and lack of attention over the past two years.

Every year Florinus records an increasing number of citizens interested in precious metals, as evidenced by the increased flow of buyers. In total, Florinus salons throughout Lithuania served 79,779 clients in 2022.

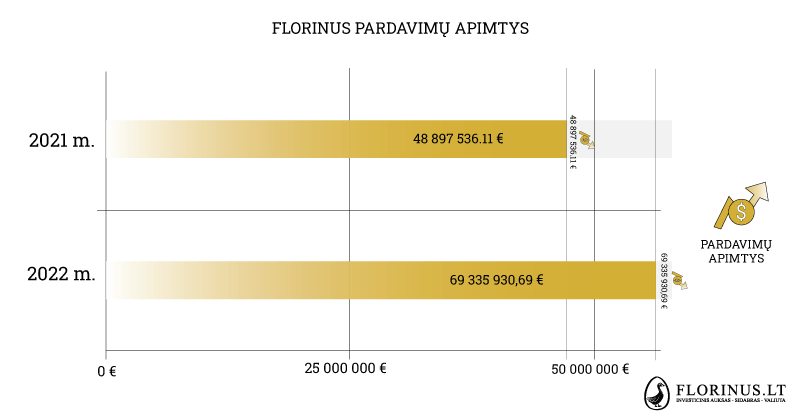

Compared to 2021, the sales turnover in 2022 was 20,438,394.58 euros higher, representing a 41.80 percent increase. The turnover of Florinus in 2022 exceeded the threshold of more than 69 million.

The most active customer flows were recorded in March, April, and December. On average, about 8 thousand customers visited Florinus salons during these months. These months have also been the busiest months for gold sales, as geopolitical uncertainty sparked by Russia's invasion of Ukraine boosted demand for the precious metal. Moreover, since March 7, in all Florinus stores, hryvnias were exchanged for euros for Ukrainian citizens fleeing the horrors of war. In total, since the beginning of March, more than 37 million Ukrainian hryvnias have been exchanged in all Florinus salons.

This is expected to be a good start to the year, as gold was already above $1,900 an ounce in mid-January. Another 10% growth would have set an all-time high. Demand for precious metals will remain strong throughout the new year as investors continue to hedge against uncertainty and volatility in global markets, according to experts at kitco.com.

Many potential economic, geopolitical, and social factors in 2023 could push the price of gold to new highs. Expert forecasts and ongoing tensions due to major economic and geopolitical headwinds around the world indicate that gold is a good investment in 2023. So instead of standing by and waiting for the market to change, you can invest in gold NOW because prices will inevitably rise.

In December last year, gold quotes (prices of last trading) repeatedly returned to levels above $1,800 per ounce and stabilized above this barrier at the very end of the year. According to experts, this allows us to expect possible further growth.

With inflation still at a ten-year high, now is the time to start increasing your holdings in gold and silver. Already in early January, the price of gold reached a six-month high, which is an early sign that the price of the precious metal will rise soon.