Are you interested in purchasing shiny gold bars or a rare collectible coin? Such a decision will most likely sustain the value of your money:

Long term gold, silver, and platinum allows you to safely diversify your investment portfolio;

Precious metals have an advantage over stocks and real estate.

You can easily monetize your investment metals during an urgent situation.

The great thing is that despite the COVID-19 pandemic the market size for precious metals will grow by nine percent by 2027 [1]. Gold is a safe choice for investment but doesn't necessarily meet all the expectations of investors.

Obviously when you are willing to allocate a chunk of your money you want to evaluate the risks. Thus, we will help you to learn about the pros and cons of investing in gold, silver, and platinum.

Choosing this investment option comes with its perks. We listed a number of advantages that will enrich your knowledge about investing in gold, silver, and platinum.

If you look for different investment opportunities you will rarely find the one you can physically touch. Precious metals withstand fire, water and can endure the test of time (silver sometimes requires maintenance). It doesn’t require specific maintenance, which makes it a convenient investment.

Nowadays we store the majority of currencies in electronic banks. In the digital environment, there is a constant threat of cybercriminals. Thus the safety of your investment relies on digital security measures. That is where precious metals stand out. Hackers can not attempt a theft on your gold coin.

How many assets can you pursue without drawing attention from others? Precious metals are an investment suitable for privacy and confidentiality. You can purchase a nice gold bar without raising awareness of third parties. This off-the-grid type of purchase makes it a low-awareness investment in this age of surveillance.

Have you ever thought about a reliable currency to leave behind for your heirs? Tangible assets like precious metals withstand a test of time when it comes to their value. Unlike many currencies throughout history that were rendered worthless after some time. It will not likely happen to precious metals so your heritage will pass on with sustained value.

Gold bars, gold coins and etc. is a safe investment that people have been relying on for centuries. However, becoming an owner of a tangible asset offers a number of hurdles. Thus, we have gathered a couple of tips for trading precious metals.

When you purchase gold, silver, or platinum you are required to pay commission. Usually, the rates are higher than the ones for stocks and bonds (doesn’t exceed real estate). These premiums often differ in the market. For example, a rare coin or a numismatic product entails a higher commission since these are collectibles

When choosing precious metals investors have to make sure to deposit their assets in a protected place. In order to secure your tangible assets, you have to arrange reliable storage or a safe.

Otherwise, you are making your investment vulnerable to theft. The safety of your loved ones must be a part of your decision-making process as well.

In this case, it is best to choose a private professional storage service provider. This decision will help you avoid the disadvantages of storing your precious metals at home. Florinus offers safe storage of the highest quality in the following countries:

When you own physical medals, it might not be possible to immediately liquidate them. Quite frankly you won’t be able to trade a gold bar into a new house or a car. You will have to find a way to turn your precious metals into currency.

Purchasing gold online might help you to avoid this process. Digital precious metal trading platforms allow you to buy and sell gold at any time of the day. It is just like buying stocks. This grants you liquidity usually as quickly as within 1-2 business days.

One of the perceived cons of precious metals is that they do not generate interest or dividends. Unlike stocks or rent accumulated from real-estate investments.

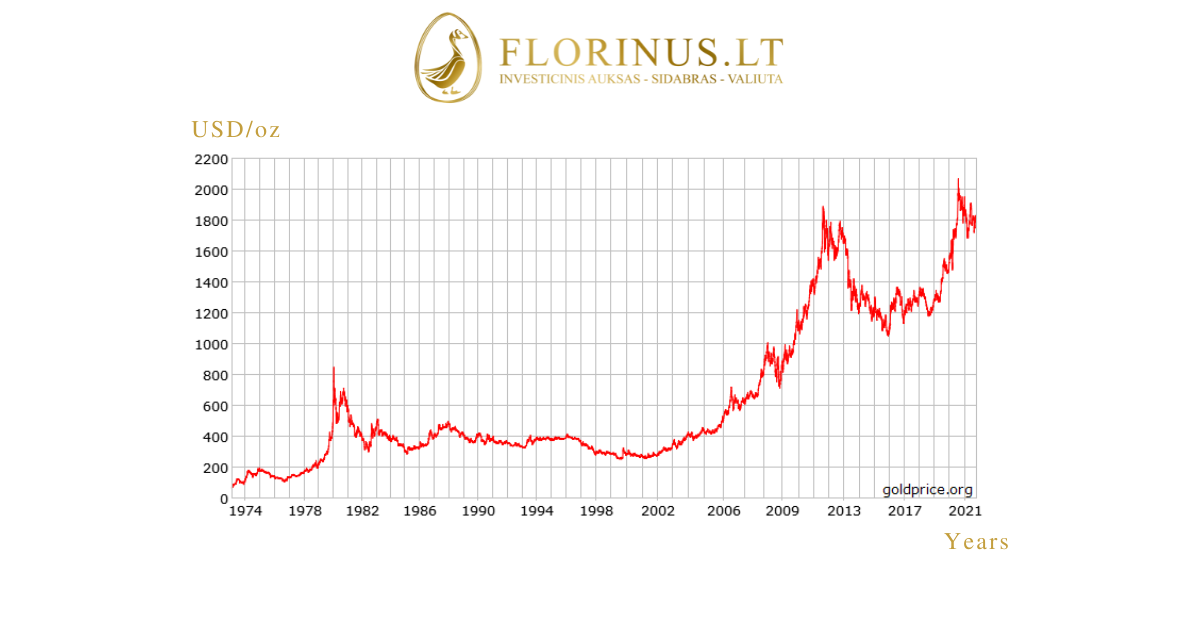

However, people choose to invest in precious metals not for their capability to gterest. Gold sustains its value in the long run, unlike national currencies, stocks, or bonds.enerate in

If you are determined to make this investment check out our store as we offer a wide range of products of the highest quality. Do you want to ensure the safety of your metals? Let us help you to minimize the risk:

https://www.florinus.lt/en/contacts

Sources: [1] https://www.grandviewresearch.com/industry-analysis/precious-metals-market